May 7, 2020

As the financial strain on the families of college students worsens, there’s one measure few schools have considered until now.

A number of colleges are freezing tuition in hopes of attracting more students and families struggling with the weight of a higher-education tab.

In the face of Covid-19, the College of William & Mary said it would roll back a previously approved 3% tuition increase and keep tuition and fees for all students unchanged for the coming year.

Delaware Valley University in Pennsylvania, Kansas City University and Central Michigan University, among other colleges across the country, all announced similar measures to freeze undergraduate tuition and fees.

“We know if we do this other universities may do it,” said Central Michigan University’s president, Robert Davies.

A number of colleges are freezing tuition in hopes of attracting more students and families struggling with the weight of a higher-education tab.

In the face of Covid-19, the College of William & Mary said it would roll back a previously approved 3% tuition increase and keep tuition and fees for all students unchanged for the coming year.

Delaware Valley University in Pennsylvania, Kansas City University and Central Michigan University, among other colleges across the country, all announced similar measures to freeze undergraduate tuition and fees.

“We know if we do this other universities may do it,” said Central Michigan University’s president, Robert Davies.

To Read More, Click Link Below:

March 19, 2020

Aarthi Swaminathan, Yahoo FinanceIn response to the coronavirus, U.S. President Donald Trump has just waived interest on all student loans.

“I am announcing the following emergency actions today: to help our students and their families, I’ve waived interest on all student loans held by federal government agencies and that will be until further notice,” he said during a press conference on Friday.

Experts reacted quickly, and they were divided on the announcement.

“Dealing with interest is an important start and I’m glad they recognized the need for action to help borrowers,” Ben Miller, vice president for postsecondary education at the Center for American Progress, told Yahoo Finance. “But they need to do more to make it easier for borrowers to pause payments, automatically prevent individuals from going delinquent, and immediately stop the seizure of tax refunds, security, and wages for defaulted loans.”

“No one should fall behind on their student debts because of this national crisis,” James Kvaal, former President Obama’s top higher education adviser, told Yahoo Finance. “Waiving interest is welcome, but the key question is whether students and parents can reduce or halt their monthly payments. Pausing payments and stopping punitive loan collections would give immediate relief to students and parents facing economic hardship and uncertainty.”

To be clear, Trump has not yet elaborated on how exactly this will take place, and whether this is for all loans or just for federal student debt, which one expert alluded to.

To Read More, Click Link Below: https://finance.yahoo.com/news/trump-waive-interest-on-student-loans-210904377.htmlFebruary 7, 2020

By Ryan Lane, NerdWallet Multiple studies have shown that student debt can cause borrowers to delay getting married. For some borrowers, though, marriage could actually be a gateway to paying less. You can save money by refinancing student loans, but not everyone qualifies. If your better half has a better financial profile, you can share the benefits of refinancing in two ways: — REFINANCE TOGETHER. You combine your student loans with your partner’s into one spousal loan with a lower interest rate. — CO-SIGN FOR YOU. Your spouse co-signs a loan refinancing your debt, getting you a lower rate on the back of his or her finances. If you’re considering getting hitched to your partner’s loans, here’s how to decide if you should. REFINANCING ‘FOR BETTER’ Refinancing makes the most sense to save money on higher-interest private and graduate school loans. For example, by refinancing a $60,000 loan from 7% interest to 5%, you’d save roughly $7,200 over a 10-year term. Typically, you’ll need robust finances and a good credit score to qualify and get the best rate. Spouses may “increase (their) chances at getting a better rate together,” says Andrew Zoeller, digital program director for Purefy, which refinances loans for Pentagon Federal Credit Union, or PenFed. For joint spousal loans and loans that spouses co-sign, PenFed evaluates the couple based on their combined income and counts shared debts, like mortgages, only once. This allows more individuals — such as stay-at-home parents with good credit — to meet PenFed’s lending criteria. Other lenders may evaluate spouses separately. Ask a lender about its policy before applying. In 2019, 67% of co-signed PenFed student loan refinances were spousal loans, according to Zoeller. “It’s something our program is known for,” he says. REFINANCING ‘FOR WORSE’ If you co-sign a refinancing loan or combine debts with your spouse, you’re equally responsible for repaying the balance — even after a divorce. “There is no exit ramp,” says Joshua R.I. Cohen, a lawyer in West Dover, Vermont, who operates TheStudentLoanLawyer.com. To Read More, Click Link Below: https://abcnews.go.com/Lifestyle/wireStory/student-loans-spouses-hitched-68798108

Multiple studies have shown that student debt can cause borrowers to delay getting married. For some borrowers, though, marriage could actually be a gateway to paying less. You can save money by refinancing student loans, but not everyone qualifies. If your better half has a better financial profile, you can share the benefits of refinancing in two ways: — REFINANCE TOGETHER. You combine your student loans with your partner’s into one spousal loan with a lower interest rate. — CO-SIGN FOR YOU. Your spouse co-signs a loan refinancing your debt, getting you a lower rate on the back of his or her finances. If you’re considering getting hitched to your partner’s loans, here’s how to decide if you should. REFINANCING ‘FOR BETTER’ Refinancing makes the most sense to save money on higher-interest private and graduate school loans. For example, by refinancing a $60,000 loan from 7% interest to 5%, you’d save roughly $7,200 over a 10-year term. Typically, you’ll need robust finances and a good credit score to qualify and get the best rate. Spouses may “increase (their) chances at getting a better rate together,” says Andrew Zoeller, digital program director for Purefy, which refinances loans for Pentagon Federal Credit Union, or PenFed. For joint spousal loans and loans that spouses co-sign, PenFed evaluates the couple based on their combined income and counts shared debts, like mortgages, only once. This allows more individuals — such as stay-at-home parents with good credit — to meet PenFed’s lending criteria. Other lenders may evaluate spouses separately. Ask a lender about its policy before applying. In 2019, 67% of co-signed PenFed student loan refinances were spousal loans, according to Zoeller. “It’s something our program is known for,” he says. REFINANCING ‘FOR WORSE’ If you co-sign a refinancing loan or combine debts with your spouse, you’re equally responsible for repaying the balance — even after a divorce. “There is no exit ramp,” says Joshua R.I. Cohen, a lawyer in West Dover, Vermont, who operates TheStudentLoanLawyer.com. To Read More, Click Link Below: https://abcnews.go.com/Lifestyle/wireStory/student-loans-spouses-hitched-68798108

January 30, 2020

By Elizabeth Hernandez, The Denver Post

January 16, 2020

By Zack Friedman, Forbes

Can you now discharge your student loans in bankruptcy?

Here’s what you need to know. Student Loans: Bankruptcy A Navy veteran will have $220,000 of his student loans discharged, even though he is not unemployable, not disabled or wasn’t defrauded. A U.S. bankruptcy judge in New York, Cecilia G. Morris, ruled that Kevin J. Rosenberg will not have to repay his student loan debt because it will impose an undue financial hardship. According the Wall Street Journal, Rosenberg borrowed $116,500 of student loans between 1993 and 2004 to earn a bachelor’s degree from the University of Arizona and a law degree from Cardozo Law School at Yeshiva University. He filed for Chapter 7 bankruptcy in 2018 and asked the court last June to discharge his student loan debt, which had grown to $221,400, including interest. At the time of filing, Rosenberg’s annual salary was $37,600, and after living and debt expenses, his monthly net loss was $1,500. Traditionally, unlike mortgages or credit card debt, student loans cannot be discharged in bankruptcy. There are exceptions, however, namely if certain conditions regarding financial hardship are met. The Brunner Test: Financial Hardship Those conditions are reflected in the Brunner test, which is the legal test in all circuit courts, except the 8th circuit and 1st circuit. The 8th circuit uses a totality of circumstances, which is similar to Brunner, while the 1st circuit has yet to declare a standard. In plain English, the Brunner standard says:- the borrower has extenuating circumstances creating a hardship;

- those circumstances are likely to continue for a term of the loan; and

- the borrower has made good faith attempts to repay the loan. (The borrower does not actually have to make payments, but merely attempt to make payments – such as try to find a workable payment plan.)

December 12, 2019

By Scott Olson, NBC News The University of Phoenix and its parent company have agreed to pay $50 million in cash and cancel $141 million in student debt to settle allegations of deceptive advertisement brought by the Federal Trade Commission. The deal, announced Tuesday, settles a dispute over an ad campaign the for-profit college launched in 2012 touting partnerships with companies including Microsoft, Twitter and Adobe. It suggested the school worked with those companies to create job opportunities for students, even though there was no such agreement, investigators found. The Federal Trade Commission said the settlement is the largest the agency has ever obtained against a for-profit college. “Students making important decisions about their education need the facts, not fantasy job opportunities that do not exist,” said Andrew Smith, director of the Federal Trade Commission’s Bureau of Consumer Protection. The University of Phoenix said in a statement that much of the dispute focused on a single ad campaign that ran from 2012 to 2014. It said it agreed to the deal “to avoid any further distraction from serving students.”

The Federal Trade Commission said the settlement is the largest the agency has ever obtained against a for-profit college. “Students making important decisions about their education need the facts, not fantasy job opportunities that do not exist,” said Andrew Smith, director of the Federal Trade Commission’s Bureau of Consumer Protection. The University of Phoenix said in a statement that much of the dispute focused on a single ad campaign that ran from 2012 to 2014. It said it agreed to the deal “to avoid any further distraction from serving students.”

“The campaign occurred under prior ownership and concluded before the FTC’s inquiry began. We continue to believe the University acted appropriately,” the company said.

Apollo Education Group owns the University of Phoenix. The Arizona-based for-profit college chain has 55 campuses across the nation and teaches thousands of students through its online programs. It’s the nation’s largest recipient of GI Bill tuition benefits for military veterans.

To Read More, Click Link Below https://www.nbcnews.com/news/us-news/u-phoenix-agrees-cancel-141-million-student-loan-debt-n1099681December 2, 2019

By Aarthi Swaminathan Student debt isn’t just a student problem. Across the U.S., many parents also struggle with the burden of student loans. A recent survey by Freedom Debt Relief found that 37% of 1,506 American adults said their children’s college education cost has made them feel financially overwhelmed. And 20% said that the stress has contributed to mental or emotional health issues. More than 40% said education costs impacted their retirement plan, with 31% indicating that they had “given up retiring when they initially desired.” Yahoo Finance spoke with one parent in a particularly difficult student loan situation: a 60-year-old factory worker from Scranton, Pa., who had cosigned a loan for his son. (The man, whom we’ll call Frank, asked for anonymity to protect his son.) ‘It’s not nice for a hard-working middle class family’ Frank’s student debt experience began when his son got into a college. As a “middle-class working family” that brings in about $75,000 a year, Frank and his son started borrowing. The son fell seriously ill after attending the school for one-and-a-half years and dropped out. After his health improved, the son decided to resume his education at a different school. All the while, both father and son continued to borrow. The expenses began mounting: The family had a refinanced mortgage and credit card debt, as well as home and car insurance to pay. On top of that, they had recurring medical bills. And there was the possibility of more kids going to college. “[With] some of my bills, I was in no position to barely help myself,” Frank said. To Read More, Click Link Below https://finance.yahoo.com/news/student-debt-family-burden-175514385.html

‘It’s not nice for a hard-working middle class family’ Frank’s student debt experience began when his son got into a college. As a “middle-class working family” that brings in about $75,000 a year, Frank and his son started borrowing. The son fell seriously ill after attending the school for one-and-a-half years and dropped out. After his health improved, the son decided to resume his education at a different school. All the while, both father and son continued to borrow. The expenses began mounting: The family had a refinanced mortgage and credit card debt, as well as home and car insurance to pay. On top of that, they had recurring medical bills. And there was the possibility of more kids going to college. “[With] some of my bills, I was in no position to barely help myself,” Frank said. To Read More, Click Link Below https://finance.yahoo.com/news/student-debt-family-burden-175514385.html

November 11, 2019

By Stacy Cowley, The New York Times

About 1,500 students who attended two art institutes that were part of the sudden collapse of a career-school chain this year will have their federal loans canceled, Education Secretary Betsy DeVos said on Friday.

It was a rare victory for borrowers seeking debt relief from a department that, under Ms. DeVos, has frozen or curtailed relief programs for students who claim that schools defrauded them. Borrowers who attended the two schools, the Art Institute of Colorado and the Illinois Institute of Art, sued the department last month, seeking to have their loans eliminated.

“Students were failed and deserve to be made whole,” Ms. DeVos said. Students who attended the schools from late January 2018 through the end of last year, when they shut down, will have their loans for that period canceled, the department said.

Borrowers will still generally owe on federal loans they took out before Jan. 20, the department said in an email sent to borrowers on Friday. Some people, however, may qualify to have all of their loans eliminated through the department’s closed school discharge program.

The decision was the latest twist in the messy unraveling of the chain, Dream Center Education Holdings, which owned dozens of campuses under the Art Institutes, South University and Argosy University brands.

Dream Center was owned by a Christian nonprofit that acquired the troubled group of for-profit schools in late 2017. It closed some schools within a few months, and the entire chain abruptly shut down barely a year later after millions of dollars in federal financial aid funds that were owed to students went missing. The money has still not been recovered.

The accreditation for the Art Institute’s Colorado and Illinois campuses was removed by the Higher Learning Commission in January 2018, around the time Dream Center took them over. The loss of certification meant that students risked being unable to transfer their credits to other schools or have their credentials recognized by employers.

Officials at the Art Institutes never told students that the campuses had lost their accreditation, according to court filings and the Higher Learning Commission.

By law, the Education Department is not allowed to release federal student loan funds to for-profit schools that are not accredited. But the department sent more than $10 million to the two schools and, according to emails and other records, told Dream Center officials that it was working to allow schools to become retroactively accredited.

To Read More, Click Link Below https://www.nytimes.com/2019/11/08/business/student-loans-betsy-devos-art-institutes.htmlNovember 5, 2019

By Kelly Burch, Business Insider During my freshman year of college, there was a five-figure gap between what my financial aid covered and what tuition cost. In hindsight, I should have seen that bill and run to my nearest community college, since the four-year university I was planning to attend was clearly unaffordable. Instead, I turned to private student loans to cover the cost. As a broke 18-year-old with no official work history, I couldn’t get approved for a private student loan on my own. My parents couldn’t either because of their credit histories. I was panicked, until an aunt offered to cosign an $18,000 loan. I was incredibly grateful at the time, and still am today. That loan allowed me to get started in a journalism program that kickstarted my career. However, in the 12 years since that loan was dispensed, I’ve learned a lot about cosigning. I recently refinanced the loan in my own name, and I’ll never ask for a cosigner again. And though I am incredibly grateful for the gift my aunt gave me, I’ll never be a cosigner myself. Here’s why.

During my freshman year of college, there was a five-figure gap between what my financial aid covered and what tuition cost. In hindsight, I should have seen that bill and run to my nearest community college, since the four-year university I was planning to attend was clearly unaffordable. Instead, I turned to private student loans to cover the cost. As a broke 18-year-old with no official work history, I couldn’t get approved for a private student loan on my own. My parents couldn’t either because of their credit histories. I was panicked, until an aunt offered to cosign an $18,000 loan. I was incredibly grateful at the time, and still am today. That loan allowed me to get started in a journalism program that kickstarted my career. However, in the 12 years since that loan was dispensed, I’ve learned a lot about cosigning. I recently refinanced the loan in my own name, and I’ll never ask for a cosigner again. And though I am incredibly grateful for the gift my aunt gave me, I’ll never be a cosigner myself. Here’s why.

Cosigning affects you, even if everything goes well

Many people think a cosigner is merely a backup payee. If the primary borrower doesn’t pay, the lender can go to the cosigner, who is also responsible for the loan. If you think about cosigning this way, there’s little risk, as long as you believe the primary borrower will hold up their end of the deal. However, that’s not the full picture. When you cosign a loan, it shows up on your credit report. Lenders consider cosigned debt just the same as they would consider debt where you’re the primary borrower. It affects your all-important debt-to-income ratio, which can limit your ability to get additional credit in the future. That means that even if the person you cosigned for is doing everything right, their loan can still change your financial situation. To Read More, Click Link Below https://www.businessinsider.com/aunt-cosigned-student-loans-ill-never-cosignSeptember 20, 2019

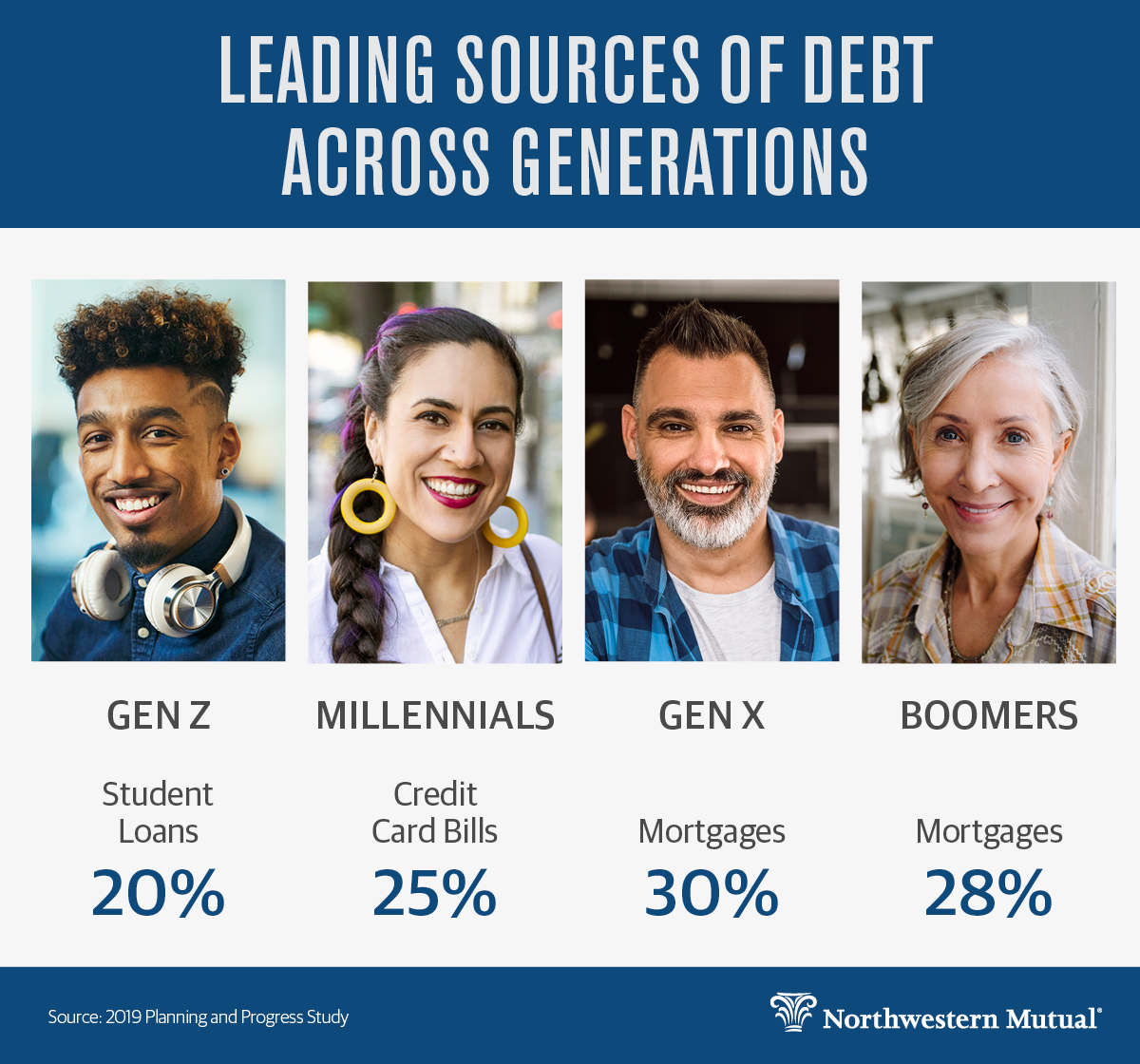

By Megan Leonhardt, CNBC “One issue that a lot of millennials have is that they have not wanted to sacrifice their lifestyle, even though they have student loans or lower incomes,” Bonneau says. “That has left us in this spot where they’ve accumulated a significant amount of credit card debt.” To Read More, Click Link Below: https://www.cnbc.com/2019/09/18/student-loans-are-not-the-no-1-source-of-millennial-debt.html

“One issue that a lot of millennials have is that they have not wanted to sacrifice their lifestyle, even though they have student loans or lower incomes,” Bonneau says. “That has left us in this spot where they’ve accumulated a significant amount of credit card debt.” To Read More, Click Link Below: https://www.cnbc.com/2019/09/18/student-loans-are-not-the-no-1-source-of-millennial-debt.html September 16, 2019

By Andrew Kreighbaum, Inside Higher ED In her first significant act as Education Secretary more than two years ago, Betsy DeVos said she planned to overhaul an Obama administration student loan rule designed to protect borrowers defrauded by their college. Despite her efforts, the Obama borrower-defense regulations took effect last year. But on Friday DeVos capped off a two-year effort by issuing her own rule, which scales back loan forgiveness opportunities for student borrowers. The new regulations significantly raise the bar for student borrowers seeking debt forgiveness based on claims they were defrauded by their colleges. They add a new three-year time limit for those borrowers to file claims, and each case will be considered individually, even if there is evidence of widespread misconduct at an institution. Borrowers will also be asked to demonstrate they suffered financial harm from their college’s misconduct and that the college made deceptive statements with “knowledge of its false, misleading, or deceptive nature.” The collapse of the Corinthian Colleges chain and subsequent flood of debt-relief claims prompted Education Department officials under the last administration to issue the 2016 borrower-defense rule. Although the rule was a response to misconduct in the for-profit college sector, it applied to all Title IV institutions. And private nonprofit college groups had expressed concerns that their institutions could be on the hook for student claims even for unintentional mistakes in marketing materials. DeVos had made clear previously that she thought the regulations were too permissive, essentially offering borrowers the chance at “free money.” “We believe this final rule corrects the wrongs of the 2016 rule through common sense and carefully crafted reforms that hold colleges and universities accountable and treat students and taxpayers fairly,” she said in a statement accompanying the rule. Education Department officials said the new three-year time limit for claims aligns with record-retention requirements for colleges. They said the process will give institutions the opportunity to respond to claims and students the chance to elaborate on claims based on those responses. The DeVos regulations will save the federal government about $11 billion over 10 years, the department estimates (the federal government shoulders the cost of loan discharge if it cannot recoup funds from the institutions themselves). Consumer advocates argue those savings are created by rigging the system against borrowers. To Read More, Click Link Below: https://www.insidehighered.com/news/2019/09/03/devos-imposes-tougher-debt-relief-standards-student-borrowers-alleging-fraud

In her first significant act as Education Secretary more than two years ago, Betsy DeVos said she planned to overhaul an Obama administration student loan rule designed to protect borrowers defrauded by their college. Despite her efforts, the Obama borrower-defense regulations took effect last year. But on Friday DeVos capped off a two-year effort by issuing her own rule, which scales back loan forgiveness opportunities for student borrowers. The new regulations significantly raise the bar for student borrowers seeking debt forgiveness based on claims they were defrauded by their colleges. They add a new three-year time limit for those borrowers to file claims, and each case will be considered individually, even if there is evidence of widespread misconduct at an institution. Borrowers will also be asked to demonstrate they suffered financial harm from their college’s misconduct and that the college made deceptive statements with “knowledge of its false, misleading, or deceptive nature.” The collapse of the Corinthian Colleges chain and subsequent flood of debt-relief claims prompted Education Department officials under the last administration to issue the 2016 borrower-defense rule. Although the rule was a response to misconduct in the for-profit college sector, it applied to all Title IV institutions. And private nonprofit college groups had expressed concerns that their institutions could be on the hook for student claims even for unintentional mistakes in marketing materials. DeVos had made clear previously that she thought the regulations were too permissive, essentially offering borrowers the chance at “free money.” “We believe this final rule corrects the wrongs of the 2016 rule through common sense and carefully crafted reforms that hold colleges and universities accountable and treat students and taxpayers fairly,” she said in a statement accompanying the rule. Education Department officials said the new three-year time limit for claims aligns with record-retention requirements for colleges. They said the process will give institutions the opportunity to respond to claims and students the chance to elaborate on claims based on those responses. The DeVos regulations will save the federal government about $11 billion over 10 years, the department estimates (the federal government shoulders the cost of loan discharge if it cannot recoup funds from the institutions themselves). Consumer advocates argue those savings are created by rigging the system against borrowers. To Read More, Click Link Below: https://www.insidehighered.com/news/2019/09/03/devos-imposes-tougher-debt-relief-standards-student-borrowers-alleging-fraud

September 4, 2019

By Elissa Nadworny, NPR

August 19, 2019

By Megan Leonhardt, CNBC

August 5, 2019

By Zack Friedman, Forbes

An educator thought she was on track to receive student loan forgiveness.

She made the payments. She thought she did everything right.

Then, she was told years later that she didn’t qualify.

Here’s what you need to know – and how you can avoid her fate.

New Lawsuit: Student Loan Forgiveness

As first reported by NPR, Debbie Baker, a Director Education at a non-profit organization in Tulsa, Oklahoma, expected that her $76,000 of student loan debt would be forgiven through the Public Service Loan Forgiveness program, a federal program through the U.S. Department of Education that forgives federal student loans for individuals who work in public service.

According to Baker, her student loan servicer – the company responsible for collecting and managing her student loan payments – allegedly told her for nine years that she met all the requirements to receive public service loan forgiveness. As such, Baker thought she would have all her federal student loan forgiven after meeting the program’s requirements, which she believed she met. However, after making her usual monthly payments under an income-driven repayment program, the U.S. Department of Education said she did not qualify for student loan forgiveness. You can imagine Baker’s reaction.

Now, Baker is a plaintiff in a new lawsuit filed by the American Federation of Teachers, one of the nation’s largest teacher’s unions, against the U.S. Department of Education, which is led by Secretary Betsy DeVos. The lawsuit alleges, among other things, that:

- the Public Service Loan Forgiveness program is “grossly mismanaged” and

- the program, as it’s currently administered, violates the Due Process Clause of the Fifth Amendment to the U.S. Constitution

- the U.S. Department of Education is aware that student loan servicers make misrepresentations to borrowers, which results in borrowers getting rejected for student loan forgiveness and suffering financial and other harm.

August 1, 2019

By Elissa Nadworny, NPR Most days, 25-year-old Chavonne can push her student loan debt to the back of her mind. Between short-term office jobs in the Washington, D.C., area, she drives for Uber. But once in awhile, a debt collector will get hold of her cellphone number — the one she keeps changing to avoid them — and it all comes back fresh. “I’ll be like, ‘Oh no!’ ” she says. “It’s a sad reminder that I owe somebody money!” In April, she got another reminder when the government seized her tax refund. All this for a degree she never finished. Back in high school, she recalls, her teachers and friends pushed her to go to college. And so, without too much thought, Chavonne enrolled at the University of Mississippi and borrowed about $20,000 to pay for it. Far away from home and in a challenging environment, she struggled — and after three semesters, she’d had enough. Her college days are five years behind her, but the debt she took on is not. Today, rent, car payments, gas and food are higher up on her list of priorities. And so she’s in default, not paying on her loans. The one thing that could help Chavonne earn more money, of course, is earning a degree. But because she’s in default, she doesn’t have access to federal student aid that could help her go back and finish. It’s a vicious cycle for Chavonne and millions of other students who leave college with debt and without a degree. From mid-2014 to mid-2016, 3.9 million undergraduates with federal student loan debt dropped out, according to an analysis of federal data by The Hechinger Report, a nonprofit news organization. The default rate among borrowers who didn’t complete their degree is three times as high as the rate for borrowers who did earn a diploma. When these students stop taking classes, they don’t get the wage bump that graduates get that could help them pay back their loans. The perception is, work hard and pay what you owe, says Tiffany Jones, who leads higher education policy at the Education Trust, “but it’s not manageable even if you’re working.” To Read More Click Link Below: https://www.npr.org/2019/07/18/739451168/i-m-drowning-those-hit-hardest-by-student-loan-debt-never-finished-college

Most days, 25-year-old Chavonne can push her student loan debt to the back of her mind. Between short-term office jobs in the Washington, D.C., area, she drives for Uber. But once in awhile, a debt collector will get hold of her cellphone number — the one she keeps changing to avoid them — and it all comes back fresh. “I’ll be like, ‘Oh no!’ ” she says. “It’s a sad reminder that I owe somebody money!” In April, she got another reminder when the government seized her tax refund. All this for a degree she never finished. Back in high school, she recalls, her teachers and friends pushed her to go to college. And so, without too much thought, Chavonne enrolled at the University of Mississippi and borrowed about $20,000 to pay for it. Far away from home and in a challenging environment, she struggled — and after three semesters, she’d had enough. Her college days are five years behind her, but the debt she took on is not. Today, rent, car payments, gas and food are higher up on her list of priorities. And so she’s in default, not paying on her loans. The one thing that could help Chavonne earn more money, of course, is earning a degree. But because she’s in default, she doesn’t have access to federal student aid that could help her go back and finish. It’s a vicious cycle for Chavonne and millions of other students who leave college with debt and without a degree. From mid-2014 to mid-2016, 3.9 million undergraduates with federal student loan debt dropped out, according to an analysis of federal data by The Hechinger Report, a nonprofit news organization. The default rate among borrowers who didn’t complete their degree is three times as high as the rate for borrowers who did earn a diploma. When these students stop taking classes, they don’t get the wage bump that graduates get that could help them pay back their loans. The perception is, work hard and pay what you owe, says Tiffany Jones, who leads higher education policy at the Education Trust, “but it’s not manageable even if you’re working.” To Read More Click Link Below: https://www.npr.org/2019/07/18/739451168/i-m-drowning-those-hit-hardest-by-student-loan-debt-never-finished-college

July 26, 2019

By Collin Binkley, ABC News Tens of thousands of federal student loan borrowers may be getting their monthly payments lowered by lying about their income and family size, yet the U.S. Education Department is doing little to catch them, according to a report released Thursday by a federal watchdog agency. Among the most extreme cases reported by the Government Accountability Office are two separate borrowers who claimed to have 93 relatives in their households, along with 3,300 cases in which borrowers said they had no income even though federal data suggest they made $100,000 a year or more. All were approved for lower loan payments. Investigators were reviewing the Education Department’s oversight of its popular income-driven repayment plans, which allow borrowers to pay lower monthly rates based on their incomes and family sizes. After 25 years of payments, all remaining debt is wiped clean. Education Secretary Betsy DeVos said her agency will conduct comprehensive review of the repayment plans and will refer cases of fraud to the Justice Department for prosecution. She placed blame on previous administrations, saying the problems are proof that “many of the policy ideas previously pursued were poorly implemented.” “Misrepresenting income or family size is wrong, and we must have a system in place to ensure that dishonest people do not get away with it,” DeVos said. “We didn’t create that problem, but rest assured we will fix it.” The federal watchdog agency says it identified 95,100 cases in which borrowers were approved as having no income even though it appears they were earning money. Using wage data from the Department of Health and Human Services, investigators found that borrowers in a third of those cases may actually have been making $45,000 a year or more, including some who topped $100,000. They concluded that the department “does not have procedures to verify borrower reports of zero income, nor, for the most part, procedures to verify borrower reports of family size.” Borrowers applying for the repayment plans can check a box indicating they have no income, and the department generally takes them at their word with no further documentation needed, the investigation found. If approved, borrowers with no income typically are not required to make monthly payments. Click Link Below to Read More: https://abcnews.go.com/Politics/wireStory/feds-find-potential-fraud-student-loan-repayment-plans-64575667

Tens of thousands of federal student loan borrowers may be getting their monthly payments lowered by lying about their income and family size, yet the U.S. Education Department is doing little to catch them, according to a report released Thursday by a federal watchdog agency. Among the most extreme cases reported by the Government Accountability Office are two separate borrowers who claimed to have 93 relatives in their households, along with 3,300 cases in which borrowers said they had no income even though federal data suggest they made $100,000 a year or more. All were approved for lower loan payments. Investigators were reviewing the Education Department’s oversight of its popular income-driven repayment plans, which allow borrowers to pay lower monthly rates based on their incomes and family sizes. After 25 years of payments, all remaining debt is wiped clean. Education Secretary Betsy DeVos said her agency will conduct comprehensive review of the repayment plans and will refer cases of fraud to the Justice Department for prosecution. She placed blame on previous administrations, saying the problems are proof that “many of the policy ideas previously pursued were poorly implemented.” “Misrepresenting income or family size is wrong, and we must have a system in place to ensure that dishonest people do not get away with it,” DeVos said. “We didn’t create that problem, but rest assured we will fix it.” The federal watchdog agency says it identified 95,100 cases in which borrowers were approved as having no income even though it appears they were earning money. Using wage data from the Department of Health and Human Services, investigators found that borrowers in a third of those cases may actually have been making $45,000 a year or more, including some who topped $100,000. They concluded that the department “does not have procedures to verify borrower reports of zero income, nor, for the most part, procedures to verify borrower reports of family size.” Borrowers applying for the repayment plans can check a box indicating they have no income, and the department generally takes them at their word with no further documentation needed, the investigation found. If approved, borrowers with no income typically are not required to make monthly payments. Click Link Below to Read More: https://abcnews.go.com/Politics/wireStory/feds-find-potential-fraud-student-loan-repayment-plans-64575667

July 23, 2019

By Annie Nova

July 18, 2019

By For CNBC Paying with paper instead of plastic helped Kristy Epperson eliminate $20,000 in student loan and car loan debt in just one year. After earning her bachelor’s degree in nursing from Wright State University in 2017, Epperson owed about $16,000 in student loans from multiple borrowers with interest rates of between 3.6% and 6.8%. She also had roughly $4,000 left on her car loan, at an interest rate of 4.2%. Even as Epperson began slowly chipping away at that debt, she managed to achieve another financial goal: homeownership. She was able to buy a place in Dayton, Ohio, with only 5% as a down payment. Becoming a homeowner forced her to take a hard look at her expenses and reevaluate her spending habits — which made her more determined to wipe out her student loan and auto debts. “If something happened, if I lost my job, I’d have no way to pay my bills,” Epperson tells Grow. “I needed a better long-term plan.” In addition to getting a second job as a substitute teacher, which brought in an extra $100 to $300 a month, Epperson created an expense spreadsheet and began tracking her purchases to help her pay down debt faster. She used her Instagram page, @DebtFreeAtTwentyThree, to share her setbacks, strategies, and accomplishments. To Read More, Click on Link Below: https://www.usatoday.com/story/money/2019/07/17/student-loans-car-loans-woman-paid-off-debt-cash-budget/1754028001/

Paying with paper instead of plastic helped Kristy Epperson eliminate $20,000 in student loan and car loan debt in just one year. After earning her bachelor’s degree in nursing from Wright State University in 2017, Epperson owed about $16,000 in student loans from multiple borrowers with interest rates of between 3.6% and 6.8%. She also had roughly $4,000 left on her car loan, at an interest rate of 4.2%. Even as Epperson began slowly chipping away at that debt, she managed to achieve another financial goal: homeownership. She was able to buy a place in Dayton, Ohio, with only 5% as a down payment. Becoming a homeowner forced her to take a hard look at her expenses and reevaluate her spending habits — which made her more determined to wipe out her student loan and auto debts. “If something happened, if I lost my job, I’d have no way to pay my bills,” Epperson tells Grow. “I needed a better long-term plan.” In addition to getting a second job as a substitute teacher, which brought in an extra $100 to $300 a month, Epperson created an expense spreadsheet and began tracking her purchases to help her pay down debt faster. She used her Instagram page, @DebtFreeAtTwentyThree, to share her setbacks, strategies, and accomplishments. To Read More, Click on Link Below: https://www.usatoday.com/story/money/2019/07/17/student-loans-car-loans-woman-paid-off-debt-cash-budget/1754028001/

July 15, 2019

By Andrew Kreighbaum For Inside Higher Ed In a bid to boost the number of students receiving financial support for college, Texas will soon become the second state to require high school seniors to complete the Free Application for Federal Student Aid before graduating. A handful of states have looked at making FAFSA completion mandatory for graduating high school students. Beginning with the 2020-21 academic year, Texas will provide a serious test case for the policy after big successes in Louisiana, which enacted the requirement last year. Search Over 35,000 Jobs Search Browse all jobs on Inside Higher Ed Careers » Completing the form is a leading indicator of college enrollment. And there’s ample evidence that more financial aid is associated with outcomes like college completion. Actually achieving big gains in FAFSA completion, though, requires significant investment and outreach by schools and state officials. During the past academic year, Louisiana saw FAFSA completions by high school students climb by more than 25 percent. College access groups say high school seniors leave millions of aid dollars on the table each year by not completing the form — often because it’s too difficult or they don’t believe they’ll qualify for aid. “As the forerunner of this kind of policy, the early successes that Louisiana has seen with mandatory FAFSA has to be encouraging for other states,” said Bill DeBaun, director of data and evaluation at the National College Access Network. “We shouldn’t assume Texas will see the same effects Louisiana did. But given the scale of the state, even a modest effect could make a big splash on the FAFSA completion cycle.” If Texas has 25 percent of the growth Louisiana saw in FAFSA completions, that would mean an additional 12,700 students submit the application, DeBaun said. To Read More, Click On Link Below: http://www.insidehighered.com/news/2019/07/10/texas-becomes-second-state-require-fafsa-completion

In a bid to boost the number of students receiving financial support for college, Texas will soon become the second state to require high school seniors to complete the Free Application for Federal Student Aid before graduating. A handful of states have looked at making FAFSA completion mandatory for graduating high school students. Beginning with the 2020-21 academic year, Texas will provide a serious test case for the policy after big successes in Louisiana, which enacted the requirement last year. Search Over 35,000 Jobs Search Browse all jobs on Inside Higher Ed Careers » Completing the form is a leading indicator of college enrollment. And there’s ample evidence that more financial aid is associated with outcomes like college completion. Actually achieving big gains in FAFSA completion, though, requires significant investment and outreach by schools and state officials. During the past academic year, Louisiana saw FAFSA completions by high school students climb by more than 25 percent. College access groups say high school seniors leave millions of aid dollars on the table each year by not completing the form — often because it’s too difficult or they don’t believe they’ll qualify for aid. “As the forerunner of this kind of policy, the early successes that Louisiana has seen with mandatory FAFSA has to be encouraging for other states,” said Bill DeBaun, director of data and evaluation at the National College Access Network. “We shouldn’t assume Texas will see the same effects Louisiana did. But given the scale of the state, even a modest effect could make a big splash on the FAFSA completion cycle.” If Texas has 25 percent of the growth Louisiana saw in FAFSA completions, that would mean an additional 12,700 students submit the application, DeBaun said. To Read More, Click On Link Below: http://www.insidehighered.com/news/2019/07/10/texas-becomes-second-state-require-fafsa-completion

July 9, 2019

By Brittany De Lea For Fox News Exorbitant college Opens a New Window. costs are a significant problem for Americans, but new research shows prospective college students are unaware of how the financial aid Opens a New Window. process works. A new study from ACT, which surveyed about 1,200 last year, found that many students “lack the most up-to-date … debt-related information” needed to make enrollment and financial aid decisions.

Exorbitant college Opens a New Window. costs are a significant problem for Americans, but new research shows prospective college students are unaware of how the financial aid Opens a New Window. process works. A new study from ACT, which surveyed about 1,200 last year, found that many students “lack the most up-to-date … debt-related information” needed to make enrollment and financial aid decisions.

- An “overwhelming majority” didn’t know that the U.S. government subsidizes a borrower by paying interest on existing loans while the student is still in college.

- A majority of respondents did not know about loan repayment options, which allows students to repay loans based on their earnings after college.

July 2, 2019

By Christy Bieber For The Motley Fool Owing money on student loans can feel like a major financial burden. After all, you have to send money to lenders each month and tons of debt shows up on your credit report. While you may be tempted to get rid of your student debt ASAP by making extra payments and throwing as much cash at it as you can, this may not actually be the best financial decision. In fact, there are a few key reasons why paying off your student loans early might be a bad idea indeed. Here are four of them. Image source: Getty Images. 1. Federal student debt comes with borrower protections you can’t get with other debt. With most types of debt, lenders don’t really care if you’re facing financial hardship — you have to pay back what you owe on schedule. And you can’t just change your payment plan to reduce your payment so it matches your income, nor can you expect to get some of your debt forgiven if you do work that serves the public. If you have federal student loan debt, on the other hand, there are unmatched borrower protections available to you. Depending on your situation, these borrower protections include: Eligibility to get loans forgiven if you work in public service and make 120 on-time payments The option to put loans into forbearance or deferment, and pause payments if you go back to school, are unemployed, serve in the military, join the Peace Corps, or meet other qualifying requirements The ability to change repayment plans and pick a plan that caps payments at a percentage of income The government may even subsidize interest on some of your loans during periods when payments are deferred. Putting extra money toward paying down loans with all these borrower protections rarely makes sense. After all, if you could pay a small percentage of your income for 10 years and get the rest of your loans forgiven because you work for the government or a nonprofit, why pay off your loans early? Click the Link Below to Read https://www.fool.com/personal-finance/2019/06/29/why-you-might-not-want-to-pay-off-your-student-loa.aspx

Image source: Getty Images. 1. Federal student debt comes with borrower protections you can’t get with other debt. With most types of debt, lenders don’t really care if you’re facing financial hardship — you have to pay back what you owe on schedule. And you can’t just change your payment plan to reduce your payment so it matches your income, nor can you expect to get some of your debt forgiven if you do work that serves the public. If you have federal student loan debt, on the other hand, there are unmatched borrower protections available to you. Depending on your situation, these borrower protections include: Eligibility to get loans forgiven if you work in public service and make 120 on-time payments The option to put loans into forbearance or deferment, and pause payments if you go back to school, are unemployed, serve in the military, join the Peace Corps, or meet other qualifying requirements The ability to change repayment plans and pick a plan that caps payments at a percentage of income The government may even subsidize interest on some of your loans during periods when payments are deferred. Putting extra money toward paying down loans with all these borrower protections rarely makes sense. After all, if you could pay a small percentage of your income for 10 years and get the rest of your loans forgiven because you work for the government or a nonprofit, why pay off your loans early? Click the Link Below to Read https://www.fool.com/personal-finance/2019/06/29/why-you-might-not-want-to-pay-off-your-student-loa.aspx

June 28, 2019

By Julia La Roche For Yahoo FinanceJPMorgan Chase (JPM) CEO Jamie Dimon says student lending in the U.S. has been “a disgrace” and it’s “hurting America.”

“Is there an issue with student debt? There is, but you’ve got to stop the creation of bad debt,” Dimon told Yahoo Finance’s Andy Serwer in an exclusive interview at the unveiling of JPMorgan’s new flagship bank branch in Midtown Manhattan.

Dimon added that the government has “irresponsibly” lent more than $1 trillion since taking over in 2010.

“And now they want to forgive it,” he said.

Student loan forgiveness has become a focal point of the 2020 election, with Democratic contenders rolling out plans. This week, Sen. Bernie Sanders (I-VT) unveiled a sweeping cancellation plan that proposed taxing financial transactions.

“I think they should look at all parts of student lending, fix the broken parts, and then forgive those people need forgiveness, and then help people get into school, and then make sure the schools are responsible in getting the kids out,” Dimon said. “And what we’ve done is a disgrace, and it’s hurting America.”

He pointed out that a tax on financial transactions would be paid by investors.

“How they go about taxing, I’ll leave that to the politicians to figure that out,” he said.

To read more, click the following link: https://finance.yahoo.com/news/jpmorgan-ceo-jamie-dimon-calls-student-loans-a-disgrace-171749043.htmlJune 26, 2017

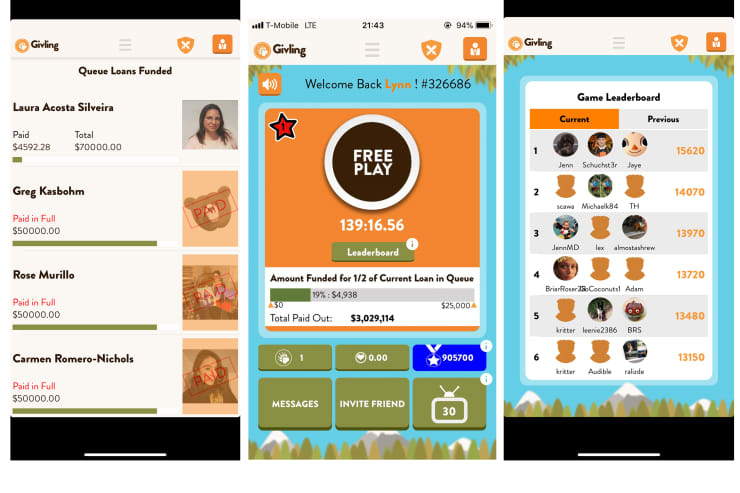

By Annie Nova For CNBC ABRA BELKE WAS IN LAW SCHOOL when she came across the Givling app, which calls itself “the world’s most incredible trivia game.” It promised winners payments toward their student debt. Belke was interested. Her student loan balance was more than $100,000 and she had previously won $62,000 on the syndicated game show, “Who Wants To Be A Millionaire.”

June 20, 2019

By Jillian Berman For MarketWatch For the past few years, the government has been taking pains to collect on Tamara Blanchette’s student loans — garnishing some of the money she receives through her tax refund. But it’s debt the government shouldn’t be collecting on in the first place, a new lawsuit alleges. The suit, filed on behalf of Blanchette and similarly situated borrowers, alleges that Betsy DeVos and the Department of Education are collecting on debt that isn’t legally enforceable. That’s because the Department knows that Blanchette and other students who enrolled in the criminal-justice program at the Minnesota School of Business, a now defunct for-profit college chain, were defrauded by the school when they signed up for the program, according to court documents. For more information click on link below: https://www.marketwatch.com/story/lawsuit-alleges-the-government-is-illegally-garnishing-tax-refunds-of-student-loan-borrowers-2019-06-19

For the past few years, the government has been taking pains to collect on Tamara Blanchette’s student loans — garnishing some of the money she receives through her tax refund. But it’s debt the government shouldn’t be collecting on in the first place, a new lawsuit alleges. The suit, filed on behalf of Blanchette and similarly situated borrowers, alleges that Betsy DeVos and the Department of Education are collecting on debt that isn’t legally enforceable. That’s because the Department knows that Blanchette and other students who enrolled in the criminal-justice program at the Minnesota School of Business, a now defunct for-profit college chain, were defrauded by the school when they signed up for the program, according to court documents. For more information click on link below: https://www.marketwatch.com/story/lawsuit-alleges-the-government-is-illegally-garnishing-tax-refunds-of-student-loan-borrowers-2019-06-19

June 18, 2019

By Victoria Yuen Center for American Progress

In fall 2017, the U.S. Department of Education released shocking findings about the long-term outcomes of student borrowers of color, particularly those who are black or African American. The data showed that the average black or African American borrower who entered college in the 2003-04 academic year had made no progress paying down their debt by 2015; in fact, they owed more than they originally borrowed. Even worse, nearly half of black or African American student borrowers had defaulted on their loans within the 12-year time period. These findings revealed a repayment crisis for black borrowers and raised serious questions about how the American higher education system serves all communities of color.

But the data have not yet led to any major plans in Congress to improve the outcomes of student borrowers of color. Just last month, for example, front-page headlines trumpeted a wealthy financier’s pledge to pay the student loan debt of an entire graduating class at historically black Morehouse College, demonstrating anew how much student debt is still weighing down African American borrowers—and why these students need systemic solutions.

Click on the link below to read more: https://www.americanprogress.org/issues/education-postsecondary/news/2019/06/18/470750/begin-solving-student-debt-education-department-must-factor-race-ethnicity/June 13, 2019

By: Andrew Kreighbaum Inside Higher Ed Senator Elizabeth Warren and other congressional Democrats delivered a warning on Tuesday about the potential dangers of income-share agreements, an alternative form of college financing increasingly popular with some critics of student loans. The lawmakers’ primary target was the Trump administration — which has expressed interest in experimenting with the agreements — but the shot across the bow also aimed at colleges operating their own ISA plans. Income-share agreements offer students financial support up front and in exchange require them to repay a portion of their income for a set number of years. They first caught on at coding boot camps and similar programs that don’t receive federal student aid. But a handful of four-year colleges have begun offering their own ISA plans and, last month, the Trump administration said it planned to pursue a federal experiment to offer income-share agreements to students. Click link below to read more: https://www.insidehighered.com/news/2019/06/05/democrats-take-aim-student-loan-alternative-and-colleges-offer-income-share

Senator Elizabeth Warren and other congressional Democrats delivered a warning on Tuesday about the potential dangers of income-share agreements, an alternative form of college financing increasingly popular with some critics of student loans. The lawmakers’ primary target was the Trump administration — which has expressed interest in experimenting with the agreements — but the shot across the bow also aimed at colleges operating their own ISA plans. Income-share agreements offer students financial support up front and in exchange require them to repay a portion of their income for a set number of years. They first caught on at coding boot camps and similar programs that don’t receive federal student aid. But a handful of four-year colleges have begun offering their own ISA plans and, last month, the Trump administration said it planned to pursue a federal experiment to offer income-share agreements to students. Click link below to read more: https://www.insidehighered.com/news/2019/06/05/democrats-take-aim-student-loan-alternative-and-colleges-offer-income-share

June 11, 2019

By Dartunorro Clark MSNBC News When Michael Sorrell became president of Paul Quinn College 12 years ago, he assessed the dire situation his school was in and made a bold choice: No more football. “I mean, we’re in Texas. We’re an HBCU in Texas,” Sorrell said. “I got a little flak for that, OK?” But to him, eliminating the program was the only way the historically black college in Dallas, which was founded in 1872 by a group of preachers from the African Methodist Episcopal Church to educate freed slaves and their children, could get back on track. Football had cost the school roughly $600,000 to $1 million a year, he said, and scholarships went mainly to the players. Meanwhile, other students struggled, faculty and staff members were leaving, and buildings had fallen into disrepair. “We were roughly 18 months to 24 months away from closing. We had financial problems. We had academic problems. We had morale problems, and it was the prototypical scenario for an institution that had been struggling for a long time and the end of the road was coming,” he told NBC News in a phone interview. The challenges Paul Quinn College faced are not unique, experts said, even if its solution was one of a kind. Click link below to read more: https://www.nbcnews.com/politics/politics-news/hbcus-crushing-student-loan-debt-symptom-even-bigger-problems-n1014171

When Michael Sorrell became president of Paul Quinn College 12 years ago, he assessed the dire situation his school was in and made a bold choice: No more football. “I mean, we’re in Texas. We’re an HBCU in Texas,” Sorrell said. “I got a little flak for that, OK?” But to him, eliminating the program was the only way the historically black college in Dallas, which was founded in 1872 by a group of preachers from the African Methodist Episcopal Church to educate freed slaves and their children, could get back on track. Football had cost the school roughly $600,000 to $1 million a year, he said, and scholarships went mainly to the players. Meanwhile, other students struggled, faculty and staff members were leaving, and buildings had fallen into disrepair. “We were roughly 18 months to 24 months away from closing. We had financial problems. We had academic problems. We had morale problems, and it was the prototypical scenario for an institution that had been struggling for a long time and the end of the road was coming,” he told NBC News in a phone interview. The challenges Paul Quinn College faced are not unique, experts said, even if its solution was one of a kind. Click link below to read more: https://www.nbcnews.com/politics/politics-news/hbcus-crushing-student-loan-debt-symptom-even-bigger-problems-n1014171

June 7, 2019

— CNBC’s Annie Nova contributed to this report. https://www.cnbc.com/amp/2019/06/06/chegg-is-helping-pay-down-its-employees-student-loan-debt.html Chegg has a new plan to help its employees deal with their student loans. And its CEO wants other companies to follow Chegg’s lead. The student-connected learning platform announced a new program Thursday that will give its entry- through manager-level workers up to $5,000 a year, if they have been with the company at least two years. Director- or vice president-level employees can get up to $3,000 annually to help pay down their student loan debt. “Corporations need to play a role here,” Chegg CEO Dan Rosensweig told CNBC’s “Closing Bell” on Thursday. “We are the beneficiaries of those people who have gotten an education — doesn’t matter if it is four year or two year or even if they completed it,” he added. “If they borrowed money and they are creating value for us, we want to help them.” Student loan debt has hit record levels, with borrowers owing a total of $1.5 trillion. About 7 in 10 college graduates have education debt.“We are taking our most vulnerable, least financially stable and we’re creating a burden on them that is unsustainable.”

June 5, 2019

June 3, 2019

(CNN)You’ve might have heard the statistic. As many as 45 million Americans have student loan debt — amounting to about $1.49 trillion total.

May 30, 2019

By Lara Takenaga Written for the New York Times

https://www.nytimes.com/2019/05/28/reader-center/international-college-costs-financing.html?action=click&module=MoreInSection&pgtype=Article®ion=Footer&contentCollection=FamilyMorehouse College’s 2019 graduates don’t have to worry about crushing student debt, since the billionaire investor Robert F. Smith pledged last week to pay it all off. Neither do graduates of colleges in countries that offer affordable tuition and generous stipends.

As young adults wrestle with student debt in the United States, where it has reached $1.5 trillion, many recent graduates in some countries are debt free.

When we asked people around the world what they paid for their higher education and how they financed it, we received nearly 800 responses from more than 40 countries.

Below is a selection of the responses, which show how government policies can shape the personal and professional choices that young adults make as they begin their careers. The responses have been edited and condensed.

Denmark

Denmark is among the countries in the Organization for Economic Cooperation and Development that spend the most on postsecondary education, at 1.6 percent of its gross domestic product. (The United States allocates 0.9 percent of its G.D.P.)

I attended the Technical University of Denmark from 2008 to 2013. All university is paid for by taxes. Books are maybe $500 per semester — lower than when I studied in the United States, but still a big expense.

Students who don’t live with their parents get a monthly stipend from the government of about $900 for living costs. Some people get more (if you have a child, for example). If you become pregnant during university, you get a year of parental leave, and you continue receiving the stipend. The stipend goes for up to six years (one year more than a typical bachelor’s and master’s degree). You can work part time up to a certain limit and still keep the stipend, but if you work too much and earn too much money, you have to pay back the stipend.

When we study abroad, we get to bring the tuition with us, and we apply for scholarships to pay other expenses like visas and plane tickets. I studied in Oregon for six months in 2011 and didn’t spend any of my own money.

Taiwan

An increased emphasis on higher education attainment has led to 45 percent of Taiwan’s population aged 15 and older earning a technical college or university degree, a 10 percent increase over the last decade, according to the Taiwanese government.

I graduated from National Taiwan University in 2012 with two majors. My tuition was about $375 per semester. The amount was just a fraction of my parents’ monthly salary, so they helped pay.

Because I didn’t go into debt for college (who should, anyway?), I didn’t feel pressure to get a job immediately or feel the need for a high-paying one. Salary wasn’t my concern; I could do whatever I wanted for my career.

— Hung-Yu Juan. Undergraduate tuition: $3,000. Loans: $0.

Ireland

Government grants help undergraduate students pay for living costs and education fees in Ireland. Some students have protested the contribution fees of 3,000 euros ($3,360) a year, calling for a publicly funded education system like those elsewhere in Europe.

The government subsidizes undergraduate college education for European Union citizens, so technically my college degree was free. However, you’re required to pay a student contribution to your university, which works out to €3,000 annually, so I paid €12,000 for my degree.

I was extremely fortunate that my parents had put aside college money since I was born, so they covered my tuition, from 2015 to 2019. They also paid for my rent and groceries. I worked throughout my degree to supplement additional costs.

Because the cost of living in Dublin is super high, I was lucky to live in an accommodation that was pretty cheap, albeit gross. Because my parents paid for my degree, its cost did not affect my day-to-day life, but I definitely lived frugally.

— Grace Browne. Undergraduate tuition: €12,000. Loans: $0.

New Zealand

The Labour Party, led by Prime Minister Jacinda Ardern, initiated a policy in 2018 that eliminates fees for postsecondary students’ first year. The policy is scheduled to extend to three years by 2024.

I’m in my third year of a six-year undergraduate medical degree at the University of Otago in Dunedin. My first year cost 7,000 New Zealand dollars ($4,600) and subsequent years cost 15,000 N.Z.D. Our government offers loans to all citizens, and residents who have been here more than three years. These loans cover full tuition (and they subsidize the rest of our fees, which, for medicine, are upward of 75,000 N.Z.D. a year). Students are also eligible for an additional loan or an allowance for living costs.

After graduation you pay 12 percent on what you earn above 19,760 N.Z.D. (for me, on a base junior doctor’s salary of 56,000 N.Z.D. a year, I would repay about 4,500 N.Z.D. a year).

As a student doing one of the longest, most expensive degrees and living away from home, my loan will be about 140,000 N.Z.D. when I graduate. However, our government administers our loans, and we don’t get charged interest (unless you leave the country for more than a year), so I have never felt like I’m being crushed by it.

— Hannah Lochore. Undergraduate tuition: 82,000 N.Z.D. Loans: 140,000 N.Z.D.

Brazil

In Brazil, postsecondary education attainment increased to 17 percent of young adults in 2015 from 10 percent in 2010, according to the O.E.C.D. This is still one of the lowest rates among O.E.C.D. countries. Access to free public universities is extremely competitive, and the demand far exceeds the number of available spots.

I graduated in 2013, and my college education cost about 100,000 Brazilian real ($25,000) for a full-time degree in economics.

I studied at a private college through a scholarship program funded by the federal government called Prouni (basically meaning “university for all” in Portuguese). This program was developed to help students from poor families have access to university; once selected, you have to prove that your family’s income fits the criteria. The students are selected through a national exam that we take after high school.

Even though there was no tuition, I had to move from the countryside to a city and support myself there. I attended a very expensive college, so I also had to deal with social differences because most of the students were from upper-middle-class households.

— Bruno Henrique Ferreira Paulino. Undergraduate tuition: 100,000 Brazilian real. Loans: $0.

In 2017, President Rodrigo Duterte signed the Universal Access to Quality Tertiary Education Act, which provides free tuition to state and local universities and colleges, as well as state-run vocational schools.

I studied at the University of the Philippines Los Baños, a top institution in my country. For my first years, 2014 to 2016, the fees were based on my family’s socioeconomic status. The base fees were about $600 per semester. We were middle class and got a discount of 60 percent, so we paid about $240.

After 2017, because my university is a public one, I enjoyed the benefits of tuition exemption.

The costs affected my career a little. My practicum, the last requirement for my degree in nutrition, was the most expensive, about $1,400. My parents had a hard time attaining this. I will take the exam to be a nutritionist and dietitian in August.

— Kiolo L. Belsonda. Undergraduate tuition: $1,440. Loans: $0.

Scotland

The Student Awards Agency Scotland, a government entity, covers the full fees of eligible Scottish and E.U. nationals who apply; the payments are sent directly to the college or university. To qualify, students must have chosen a course that is funded by the agency and meet certain residency criteria. The Scottish government also sets the tuition rate for these students. For the 2019-20 academic year, tuition is as high as 1,820 British pounds ($2,300), depending on the program.

I’m a European citizen, so my undergraduate tuition at the University of St. Andrews, from 2012 to 2016, was paid by the Scottish government. My parents paid for my accommodation during those years, and I worked part time to fund all other expenses.

Now, my integrated master’s and doctoral degree is funded through the United Kingdom-based Economic and Social Research Council, Scottish Graduate School of Social Science. This covers tuition and a stipend of about £1,200 a month, which I supplement with part-time teaching and research assistant work at the university, as well as a part-time job in a cafe.

Because university was essentially free for me, I had a lot more freedom to pursue my interests, including further education and academic work.

— Olga Loza. Undergraduate tuition: £7,280. Loans: $0.

Turkey

The share of Turkey’s population aged 25 and older that had earned a bachelor’s degree or the equivalent increased to 14.8 percent in 2016 from 7.3 percent in 2004, according to the Unesco Institute for Statistics. (In the United States, one-third of adults in 2015 had a bachelor’s degree or more education, according to the United States Census Bureau.)

I attended Bilkent University in Ankara from 2006 to 2012 and didn’t pay for my undergraduate legal education. This was possible due to Turkey’s university entrance exam system. By ranking among the top 100 of more than 1.5 million exam takers, I attended a private university for free.

Both state and private institutions are among the best-ranking universities in Turkey. State universities are usually free or have minimal tuition. To compete with state universities, private institutions offer tuition-free quotas.

The government offers stipends to help cover living expenses. Based on the recipient’s income level, these monthly payments are either loans or grants. Exam takers who rank in the top 100 in different score categories receive three times this monthly amount regardless of their income level. This was how I covered my living expenses without burdening my parents.

Going into law without any cost gave me the opportunity to attain higher middle-class income levels despite my parents’ low- to middle-class income level.

— Mustafa Cetin. Undergraduate tuition: 225,000 Turkish lira ($37,000). Loans: $0.

Canada

For the 2017-18 academic year, the average cost of undergraduate tuition for Canadian full-time students was about 6,500 Canadian dollars ($4,800), according to Statistics Canada, a government agency. In 2010, the most recent year with available data, half of all students who earned a bachelor’s graduated with debt; the average was 26,300 Canadian dollars. (In 2018, people in the United States with outstanding education debt typically owed between $20,000 and $25,000.)

The cost of my bachelor’s degree from McGill University was about 6,000 Canadian dollars per year for four years, plus books, student fees and living expenses. In total, it was about 50,000 Canadian dollars for all four years.

My parents and I had saved up for the cost of all school expenses. I worked during the summers to be able to pay for living expenses, and my parents helped me where they could so that I could focus on my studies without taking a part-time job during the school year. Because of the reasonable cost of the education, my parents’ forward-thinking approach and my decisions to work during the summer, I did not experience any financial hardships and I graduated without student debt.

Graduating debt free allowed me freedom of opportunity and choice to find my own path and try out different jobs, including working abroad. I was also able to find the right fit and industry, and to walk away from companies and bosses who treat employees unfairly.

— Casey Reynolds. Undergraduate tuition: 24,000 Canadian dollars. Loans: $0.

May 28, 2019

The Growing Trend Of Retiree Student Loan Debt

By Robert Farrington https://www.forbes.com/sites/robertfarrington/2019/05/22/the-growing-trend-of-retiree-student-loan-debt/#256c9c9a46a4

May 24, 2019

Burger King’s Dystopian Student-Debt Sweepstakes

By Adam Harris https://www.theatlantic.com/education/archive/2019/05/burger-kings-dystopian-student-debt-sweepstakes/590257/

May 20, 2019

Morehouse College grads are surprised by a billionaire’s promise to pay off their student loans

https://www.cnn.com/2019/05/19/us/morehouse-robert-smith-student-loans-trnd/index.html

May 15, 2019

The latest victims of the student debt crisis — parents

By https://www.cnbc.com/amp/2019/05/10/the-latest-victims-of-the-student-debt-crisis-parents.html

May 10, 2019

Good news for most student-loan borrowers: Interest rates are going down

By Jillian Berman Updates on new federal student loan rates to take effect July 1, 2019. https://www.marketwatch.com/story/good-news-for-federal-student-loan-borrowers-interest-rates-on-their-loans-are-going-down-2019-05-09

April 30, 2019

Don’t Bail Colleges Out of The Student Loan Mess They’ve Made

By Nathanael Blake An opinion piece on the student loan crisis and who should be held responsible. https://thefederalist.com/2019/04/29/dont-bail-colleges-student-loan-mess-theyve-made/

April 23, 2019

Natty Light is donating $10 million to offset ‘crippling’ student-loan debt, and it reveals a dark reality about America

By Kate Taylor Originally Posted-Jan 15, 2019 Yes… You read that right, Anheuser-Busch is jumping into the student loan fight! https://amp.businessinsider.com/natty-light-donate-10-million-student-loan-debt-2019-1

April 16, 2019

Here’s What The 2020 Presidential Candidates Say About Your Student Loans

April 11, 2019

The following link is a piece written by Clair Boston for Bloomberg Businessweek, detailing the experience of Amy Wroblewski. Amy is a graduate of Purdue University and currently repaying her student loans using an income sharing agreement, or ISA. Read more of her story through the link provided. College Grads Sell Stakes in Themselves to Wall Street My initial YouTube video discussion about income sharing agreements. New Ways To Pay Student Loans

The following link is a piece written by Clair Boston for Bloomberg Businessweek, detailing the experience of Amy Wroblewski. Amy is a graduate of Purdue University and currently repaying her student loans using an income sharing agreement, or ISA. Read more of her story through the link provided. College Grads Sell Stakes in Themselves to Wall Street My initial YouTube video discussion about income sharing agreements. New Ways To Pay Student Loans