Why So Happy?

Waking up Monday mornings is always a drudgery for our house. But this Monday morning, as I groggily walked to the restroom to wash my face, my wife wore a beaming smile and greeted me cheerily. Her greeting was contrastingly returned with a slowly motioned wave and mummified growl, “Morning.”

Despite my groggy state, I couldn’t help but be suspicious about her extra energy boost. While reaching for a washcloth, in the corner of my eye, was a pregnancy test leaning against the wall. I tried to delete the image of the pregnancy test to shield myself from fear and pain.

Despite my groggy state, I couldn’t help but be suspicious about her extra energy boost. While reaching for a washcloth, in the corner of my eye, was a pregnancy test leaning against the wall. I tried to delete the image of the pregnancy test to shield myself from fear and pain.

My wife and I have been married for 5 years and were coming to terms with the possibility of never being able to conceive. I assumed the pregnancy test would read negative, but out of hope, I took a peek at it anyway.

To my amazement and disbelief the test read positive. Then I thought, wait, this is an April Fools’ joke, why would she do something so mean? But this was in November, April was 5 months away. Then my attention was drawn to sticky notes my wife placed above the pregnancy test where she wrote, “We prayed and God answered.”

Still half-conscious, it clicked.

“Wait… we’re pregnant?!”

Almost instantly, the sleep fell from my eyes.

She grabbed my hands and excitedly screamed, “Yes, we’re pregnant!”

I can’t explain the joy in knowing that my little girl will be here in August; I feel alive again!

Sacrifices of Parenthood

Once the initial elation surrounding my little girl’s arrival wore off, the reality of newfound responsibilities rose to the surface. We will lose sleep, time, and maybe even some friends. And of course, as we all know, raising a child can come with a considerable price tag. Half of me is joyful in anticipation of my child’s arrival, and the other half is anxious. I still have student loan debt to repay and sometimes wonder if waiting longer before starting a family was the better option.

But I am proud to have the opportunity and privilege to raise a child.

Fatherhood is the best gift imaginable, especially since for us, the seemingly impossible became possible. Two little eyes will be looking to me with love every day from this point on, and a little mouth will call me “dada”. Why would I not want the gift I have been given after being blessed with it?

With that in mind, I now prioritize savings over debt reduction in anticipation of the costs of raising a child as well as any birthing complications. Although I want to get rid of student loan debt faster, it would be a pity not to provide for my family first.

New Debt Payment Plan

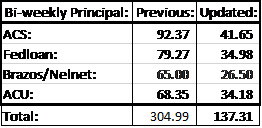

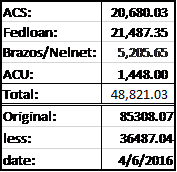

My student loan accounts are paid bi-weekly, totaling initially $425.51 every two weeks as shown below. I have since reduced the amounts made on the debt to an updated amount of $248.76.

The principal paid bi-weekly has decreased from approximately $304.99 to $137.31, due to reduction in repayment. It’s a little disheartening to see my momentum slow a bit; but one thing’s for sure, my debt is decreasing.

What matters most is my beautiful wife and daughter are healthy and strong.

For all the parents out there, how have you tackled the financial responsibilities of student loan debt and parenthood?

Until next time folks, fight on.