September 20, 2019

By Megan Leonhardt, CNBC

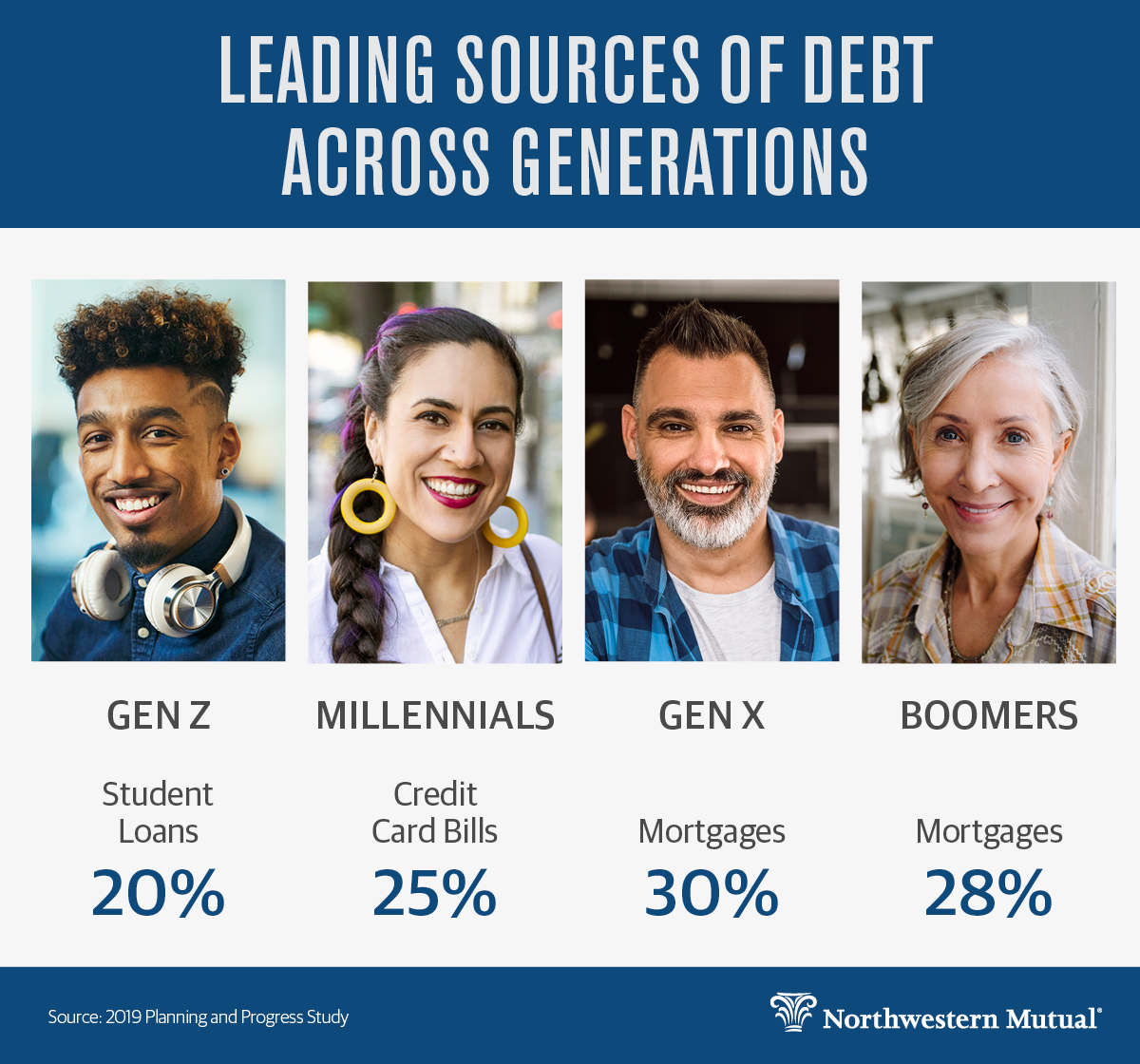

It may seem like student loans and millennials are inextricably linked. But a new survey shows that education bills are not the leading source of debt among this generation.

Millennials (defined here as ages 23 to 38) have racked up an average of $27,900 in personal debt, excluding mortgages, according to Northwestern Mutual’s 2019 Planning & Progress Study. The findings are based on a survey conducted by The Harris Poll of over 2,000 U.S. adults.

The biggest source of debt? Credit card bills. And that’s a “troubling” trend, Chantel Bonneau, a financial advisor with Northwestern Mutual, tells CNBC Make It.

“One issue that a lot of millennials have is that they have not wanted to sacrifice their lifestyle, even though they have student loans or lower incomes,” Bonneau says. “That has left us in this spot where they’ve accumulated a significant amount of credit card debt.”

To Read More, Click Link Below:

https://www.cnbc.com/2019/09/18/student-loans-are-not-the-no-1-source-of-millennial-debt.html

good post…thanks for share

LikeLiked by 1 person